Project Overview

Managing money shouldn’t feel like a second job. This tracker makes it easy—log income, track spending, and actually know where your cash is going. No complicated spreadsheets, no messy calculations—just a clean, simple way to stay in control.

Saving up for something big? Set a goal, watch the numbers climb, and let the system keep you on track. Smart alerts call out overspending before things get out of hand. Every dollar, every expense, every goal—organized, clear, and right at your fingertips.

Built with React, Node.js, and MongoDB, it runs smooth, syncs with banks, and keeps data locked down tight. Bank syncing, automatic reports, and killer analytics make managing money feel effortless.

Big upgrades are coming—investment tracking, AI-powered financial advice, and even automatic tax filing. Say goodbye to financial chaos and hello to smarter spending.

Introduction

Purpose

The purpose of this project is to develop a Money & Expense Tracker, a personal finance tool that enables users to track their income, manage their expenses, and set financial goals. The platform will offer features for categorizing expenses, generating reports, and providing insights into spending habits. This tool will be suitable for individuals, freelancers, or small businesses looking to track their financial activities and improve money management.

Scope

- Users can track and categorize their income and expenses.

- The platform will allow users to set a monthly budget and track progress against it.

- Users will have the ability to create and monitor savings goals (e.g., saving for a vacation, emergency fund).

- Analytics and reports will help users understand their spending habits and financial progress.

- The system will offer the ability to export reports and sync with financial institutions (via APIs).

Target Audience

- Individuals who want to track their personal expenses and monitor financial health.

- Freelancers who need to manage income from different sources.

- Small businesses that need to track operational expenses and profitability.

- Budget-conscious users who want to set financial goals and stay within their limits.

Definitions, Acronyms, and Abbreviations

- Income – Money received, typically as payment for work or services.

- Expenses – Money spent on goods or services.

- Savings Goals – Targets for setting aside a certain amount of money for future use.

- Budget – A plan for managing income and expenses over a given period.

- Reports – Summaries of financial data showing income, expenses, and progress toward goals.

System Features

User Registration & Authentication

- Sign-up/Login: Users can create an account to store their financial data securely and access it across devices.

- Authentication: Users will authenticate via email, password, or OAuth (e.g., Google or Facebook) for security.

Income & Expense Tracking

- Manual Entries: Users can enter income and expense records manually, categorizing them (e.g., rent, groceries, salary).

- Recurring Entries: Users can set recurring income or expenses (e.g., monthly salary, subscriptions).

- Multiple Categories: Expenses and income will be grouped into customizable categories (e.g., food, transportation, entertainment).

- Expense Notes: Users can add notes or descriptions for each entry for clarity.

Budgeting

- Set Monthly Budget: Users can define a monthly budget for each category (e.g., $500 for groceries).

- Budget Progress Tracker: The system will track progress against the defined budget, showing how much of the budget has been used.

- Alert Notifications: If the user is approaching or exceeding the budget in any category, the system will send an alert.

Savings Goals

- Create Savings Goals: Users can set specific savings targets (e.g., saving $1,000 for a vacation).

- Track Goal Progress: The system will show progress toward each goal and allow users to adjust amounts or due dates.

- Automatic Savings Deduction: Users can choose to automatically set aside a certain percentage of income for savings goals.

Reports and Analytics

- Expense Breakdown: Users can view a detailed breakdown of their income and expenses by category (e.g., pie charts, bar graphs).

- Monthly Overview: The system will provide a monthly summary showing income, expenses, savings, and budget progress.

- Spending Trends: The system will analyze spending patterns over time and provide suggestions for reducing expenses.

- Export Reports: Users can export financial data to CSV or PDF for further analysis or tax purposes.

Data Sync & Integration

- Bank Account Integration: Users can sync their accounts with external financial institutions to automatically pull in transaction data.

- API Integration: Integrate with popular payment and banking services (e.g., PayPal, Stripe, and banks) to track income and expenses automatically.

Security and Data Privacy

- Data Encryption: All sensitive financial data will be encrypted during transmission and storage.

- Two-Factor Authentication (2FA): Users can enable 2FA for added security during login.

- User Privacy: Data will be stored securely, and privacy policies will ensure users’ financial information is protected.

User Interface (UI)

- Intuitive Dashboard: A user-friendly dashboard will display income, expenses, and savings goals at a glance.

- Mobile-Friendly: The system will be mobile-responsive, ensuring accessibility on smartphones and tablets.

- Customization Options: Users can customize the look and feel of their dashboard (e.g., light/dark theme, preferred currency).

Notifications

- Budget Alerts: Alerts for when users are approaching or exceeding their budget.

- Goal Progress Notifications: Updates on the progress of savings goals.

- Transaction Alerts: Notifications for new income or expense entries and any linked account activity.

Technology Stack

Frontend

- HTML5 / CSS3 for page structure and styling.

- JavaScript (React.js / Vue.js) for a dynamic, responsive user interface.

- Bootstrap / Tailwind CSS for layout and responsive design.

Backend

- Node.js / Express.js for server-side functionality and APIs.

- MongoDB / PostgreSQL for storing user data, transactions, budgets, and goals.

- OAuth for authentication and account linking.

- Stripe / PayPal API for transaction handling and income tracking.

Hosting & Deployment

- AWS / Heroku for server hosting and database management.

- Firebase for real-time database management, especially for sync features and notifications.

Security

- SSL Encryption for secure data transfer.

- JWT (JSON Web Tokens) for secure user authentication and session management.

Integration Services

- Integration with banking APIs like Plaid for automatic income/expense sync.

- Zapier for further integrations with financial tools or apps.

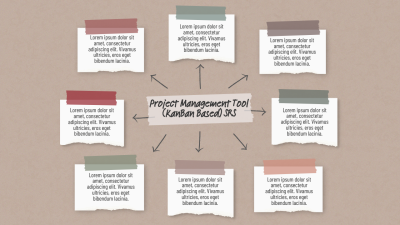

System Architecture

High-Level Overview

- Frontend: User interface for entering transactions, setting goals, and viewing reports.

- Backend: Manages data and business logic, including processing user inputs and syncing with external APIs.

- Database: Stores user data, financial records, budgets, goals, and transaction history.

- External Integrations: Sync with financial institutions, payment processors, and other external tools.

Flow of Data

- The user logs in or registers an account and sets up their initial financial information.

- The user enters income and expense data manually or links bank accounts for automatic tracking.

- The system updates the user’s budget progress and notifies them of any overspending.

- The user sets savings goals and tracks progress.

- The system generates reports and analytics to provide insights into the user’s financial health.

- The user receives notifications based on their spending patterns and goals.

Implementation Guide

Development Environment Setup

- Install Node.js and set up an Express server for handling API requests.

- Set up a MongoDB or PostgreSQL database for storing user data securely.

- Use React.js for creating the frontend interface and connecting it with the backend API.

Core Feature Development

- Income/Expense Tracking: Develop the system for manually adding and categorizing transactions.

- Budgeting: Implement functionality for users to create budgets and track their progress.

- Savings Goals: Build the feature for setting and tracking savings goals.

- Reports and Analytics: Integrate data visualization libraries to generate graphs and reports.

Testing & Debugging

- Test the user registration and authentication flows.

- Ensure that transactions, budgets, and goals are correctly calculated and tracked.

- Test integration with external banking services and payment processors.

Deployment

- Deploy the backend on AWS or Heroku and ensure that the database is properly set up.

- Ensure the frontend is responsive and functional on various devices.

Testing & Deployment

Functional Testing

- Test the budgeting, tracking, and reporting features.

- Test the accuracy of savings goals and their progress tracking.

Security Testing

- Conduct penetration testing to ensure the security of financial data.

- Ensure proper data encryption and user authentication.

Deployment

- Deploy on AWS/Heroku and test scalability with multiple users.

- Monitor the system for bugs or issues after launch.

Future Enhancements

- Automated Tax Filing: Integration with tax software to help users file taxes based on tracked expenses.

- Investment Tracking: Ability to track investments like stocks, real estate, etc.

- Debt Management: Add tools for managing and tracking loan payments or credit card debt.

- AI Financial Advisor: Use AI to provide personalized advice based on spending habits and financial goals.

Conclusion

Money flows better when there’s a plan. Keeping track of income, expenses, and savings makes every decision feel smarter. Small habits build big financial wins, and clarity turns stress into confidence. Smart insights help with better choices, and goals feel closer every day. More features are on the way to make managing finances even smoother. A better way to stay on top of money, with zero hassle.